Chronos

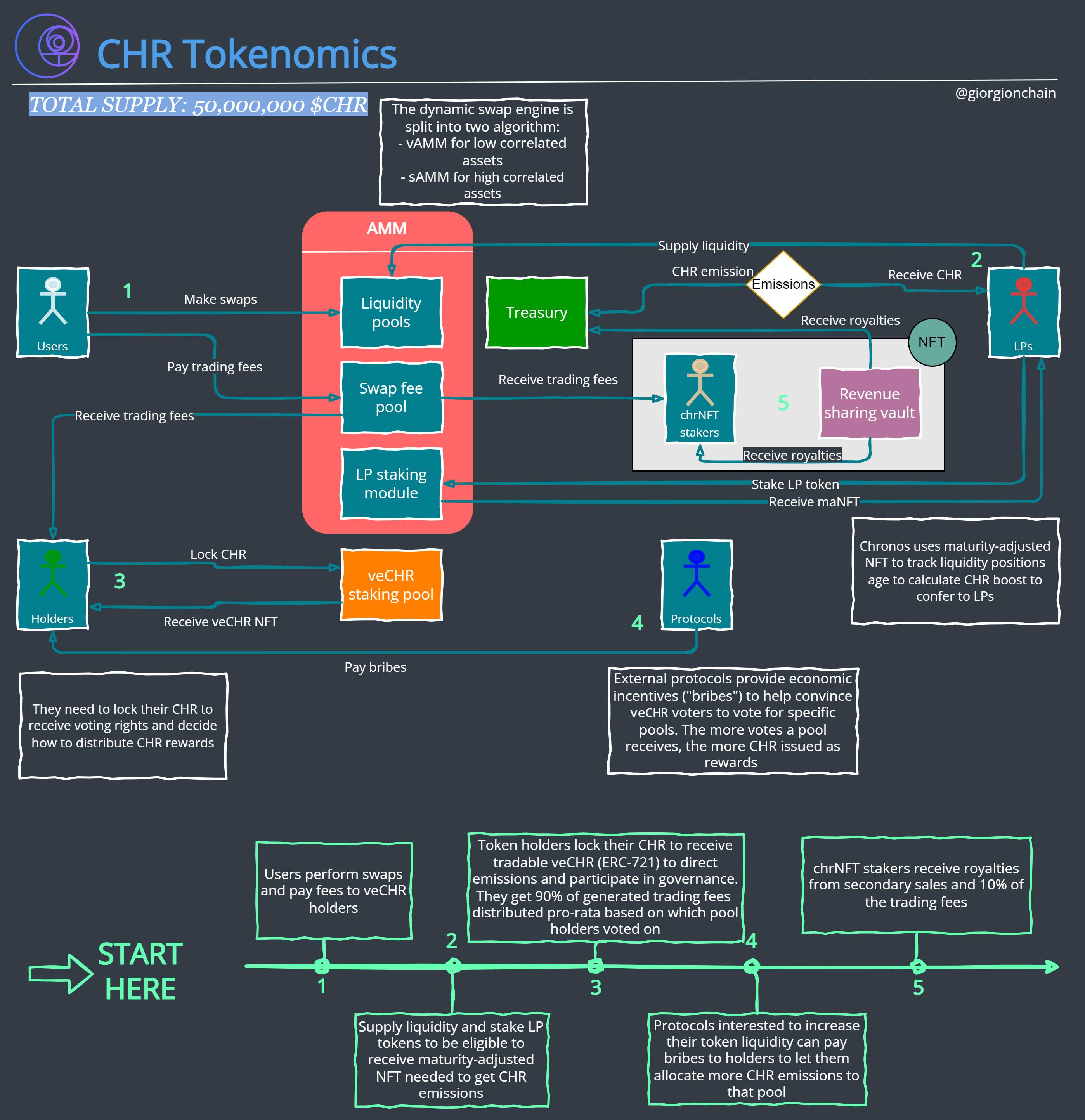

Chronos is a community-owned decentralized exchange (DEX) on the Arbitrum Layer 2 (L2) network, aimed at fostering DeFi growth through sustainable liquidity incentives. It leverages an adjusted ve(3,3) model with a unique incentive structure.

Categories:

DeFi

Updated:

2023-08-22

Tags:

AMM

DEX

Ticker:

CHR

Token Strength.

Token Utility:

- $CHR (Utility Token) The principal utility token for Chronos is $CHR, an ERC-20 token utilized to motivate users to add liquidity and stake their LP tokens on the platform. LPs find the token attractive as trading fees are not received directly; instead, LP tokens must be staked to obtain the right to receive $CHR emissions. The procedure of staking LP tokens results in a maturity-adjusted return model, thereby encouraging LPs to commit their liquidity for extended periods to gain maximum rewards. Consequently, this aligns Chronos' TVL with the project's long-term sustainability and health. - $veCHR (Governance Token) Any holder of $CHR can vote-escrow their tokens and receive an ERC-721 $veCHR in return. This grants holders the ability to vote on the platform's gauges, which regulate the distribution of $CHR incentives to Chronos' liquidity pools. $veCHR voting power declines over time, encouraging users to frequently renew their locks for ongoing participation in the Chronos ecosystem. Benefits for $veCHR holders include weekly voting for gauges to allocate $CHR emissions, governance participation, earning 90% swap fee revenue and 100% of the bribes for pools they voted for, with the remaining swap fees allocated to $chrNFT stakers.

Demand Driver:

- Arbitrum's success: Chronos' prosperity is linked to Arbitrum's activity. Traders and DAOs/protocols on Arbitrum require a DEX for liquidity, driving demand. - Locking mechanisms: by acquiring $veCHR or $chrNFT through staking $CHR, tokens in circulation may decrease, potentially raising the price if demand is high. This also grants holders governance rights, secondary bribe income, and a share of sale royalties and swap fees. - Low fees and user-friendly interface: Chronos attracts users due to its low transaction costs and intuitive interface. These users prefer token swaps with minimal slippage, necessitating high Total Value Locked (TVL). - Long-term commitment of LPs: the platform design encourages LPs to make long-term deposits, ensuring a large TVL and, therefore, promoting demand. - Token utilities: ranging from locking, governance, fees revenues

Value Creation:

The Chronos ve(3,3) system guarantees a steady cash flow to $CHR lockers from swap fees, along with voting rights, which give the power to direct $CHR emissions towards high-volume and bribed pools – a function that lets protocols to induce holders to direct more $CHR emissions toward specific pools. Interestingly, protocols can directly incentivize $CHR lockers to allocate more emissions to their own liquidity pools. When lockers are deciding on emissions, they are influenced by the fees generated and bribes offered, optimizing the gauge system and resulting in better-aligned $CHR emissions. This solution aims for improved capital efficiency and sustained liquidity for DAOs and protocols. It is also worth mentioning that Chronos isn't really a typical ve(3,3) DEX as it gets rid of the rebase function present in most ve(3,3) protocols. In summary: - Reliable trading and UI: Chronos enables dependable digital asset trading with minimal fees and limited slippage. Its routing engine optimizes returns on trades from accessible pools. Users benefit from a nice and intuitive UI, finding it easy to interact with the platform. - Incentive-aligned model: Chronos proposes an incentive-aligned model where DAOs stimulate their pools through bribes and direct more $CHR emissions to them, which is a potential demand driver. - Direct incentives: projects can directly incentivize $veCHR voters, providing an additional income source and enabling efficient liquidity procurement without high native token emissions. - TVL stability: by following the Chronos ve(3,3) model in which LPs are incentivized to keep the liquidity due to the maturity adjusted mechanism.

Value Capture:

- Value accrual to token In the Chronos ecosystem, $CHR holders can choose to vote-escrow their tokens, obtaining $veCHR in return. These $veCHR serve dual purposes: they allow holders to participate in voting on the platform's gauges, influencing the distribution of $CHR to liquidity pools, and they also enable holders to share in the platform's trading fees. The decision to lock tokens to obtain $veCHR is equally beneficial in both asp - Value accrual to protocol The treasury is instrumental in bolstering ecosystem development, and initially draws sustenance from the token allocation and a portion of the $chrNFT primary sale. A significant 60% of the funds accrued from sales is allocated towards providing $CHR liquidity and enriching the treasury at launch. The remaining 40% is earmarked for ongoing development, marketing, team expenses, among other costs. The treasury sees value accrual via a perpetual 2% inflow from all secondary NFT sales and 5% from weekly $CHR emissions. The protocol certainly benefits from high TVL to ensure deep liquidity and low slippage so as to attract more users using the platform. For this reason, Chronos adopts a unique strategy to reward LPs. Intriguingly, LPs do not receive any trading fees, instead, they are awarded $CHR emissions subject to a voting process by $veCHR holders. The model enables liquidity providers to accrue enhanced emissions over time, whereby positions staked for longer durations garner higher $CHR percentages per epoch.

Business Model:

- The business model for Chronos is: Chronos aims to become a community-owned liquidity layer on Arbitrum, gaining initial funding through the sale of a limited NFT collection, the Lost Keys of Chronos ($chrNFT), and deriving ongoing revenue through a modified fee structure on swap transactions and royalties from secondary NFT sales. - Revenues come from: Revenue is generated from the initial NFT sales and ongoing swap transaction fees and NFT sale royalties. Chronos gathered its initial funds from selling 5,555 $chrNFTs with varying price structures. The funds from the initial sale were used for providing $CHR liquidity, bolstering the treasury, continuous development, marketing, audits, team expenses, etc. Post-initial sale, Chronos secures ongoing income from swap transaction fees (vAMM: 0.20%, sAMM: 0.04%), primarily directed to $veCHR voters and $chrNFT stakers. In addition, Chronos accrues revenue from secondary NFT sales, allocating a percentage of royalties to $chrNFT minters and stakers. - Revenue is denominated in: Chronos collects NFT royalties in $ETH, and swap fees are distributed to holders depending on the pool, usually in the token pair or $CHR. Bribes, another revenue stream for the protocol, can be paid with any assets supported by Chronos.

Loading

Protocol Analysis.

| Problems & Solutions | Problem: Conventional decentralized exchanges (DEXs) face issues regarding revenue accrual for governance token holders and adequate incentives for LPs. Insufficient swap/trading fees often require liquidity mining programs, which may adversely affect token long-term value. Transferring income from LPs to the DEX can lead to liquidity reduction and decreased trading volumes. Chronos aims to address the problem of the ve(3,3) model where LPs earn direct fees and token emissions, attracting mercenary agents who negatively impact the platform's total value locked (TVL) and create unfavorable trading conditions. Solution: Chronos enables reliable digital asset trading with low fees and limited slippage. It uses a ve(3,3) model to channel transaction fees to $veCHR voters, incentivize liquidity providers with $CHR emissions, allow protocols to incentivize $veCHR voters, and sustain $CHR emissions. This structure rewards holders who lock their $CHR, ensuring in-depth liquidity. Projects can incentivize $veCHR voters, providing additional income for $veCHR lockers and efficient liquidity procurement. Chronos is proposing an incentive-aligned model, potentially increasing demand for the protocol, where DAOs stimulate their pools through bribes and direct more $CHR emissions to them. |

|---|---|

| Predecessors | Solidly: Solidly is a self-optimizing decentralized exchange. It optimizes primarily for capital-efficient acquisition of healthy TVL, meaning aggregated gauges which create the high fees for veSOLID holders. In contrast to Uniswap or Curve, which return 0% or 50% of fees to $UNI or $veCRV, respectively, Solidly distributes 100% of the fees to its governance token while also trying to achieve a 100% dilution protection. Chronos is actually a fork of Solidly. Velodrome: Velodrome is a decentralized AMM modeled on Solidly and designed to be a public good that provides deep liquidity and low slippage to token pairs critical for the growth of the Optimism ecosystem. It aims at combine the best of Curve, Convex, and Univ2 into a cohesive AMM native liquidity layer and growth engine. |

Investment Take

... coming soon

Tokenomics Timeline.

2023-03-29

NFT minting

2023-04-27

TGE

Token generation event, start of epoch 0 which includes staking, liquidity supply and bribes

2023-05-04

Epoch 1

Start of epoch 1, CHR airdrop for minters

2023-05-11

Epoch 2

Start of epoch 2

2023-06-05

V2 announcement

Major improvements: increase in emissions weekly decay, tot supply reduced, UI/UX improvements, revised maturity curve, NFT marketplace

Loading

Loading

Loading

Ecosystem Users.

| Name | Role | |

|---|---|---|

| $veCHR voters (Holders) | This kind of agent buys and locks $CHR to receive a ERC-721 (NFT) $veCHR to be eligible to participate in the governance process and control $CHR emissions direction. In order to maximize fees he gets, he is incentivized to vote to direct incentives to high-volume and most bribed pools. The ERC-721 token can be traded in the Chronos marketplace. Finally, holders interact with protocols to accumulate bribes if they vote (direct emissions) for selected pools (the pool that the protocol is bribing). | |

| Liquidity Providers | When depositing liquidity, they get LP tokens that can be staked to obtain maNFT. They don’t directly receive fees generated from swaps, as per usual AMMs design, rather they receive newly minted $CHR. With the maturity-adjusted return model, which directly derives from the Reliquary framework, LPs are also incentivized to commit their liquidity for a longer duration to receive maximal rewards. This aligns Chronos TVL with the long term health and sustainability of the project. | |

| NFT holders | Minters and holders of the Lost Keys of Chronos collection are also an integral part of the economy, as they funded the project. 60% of funds raised from sales were used for liquidity provision and treasury setup, while the rest supported ongoing tasks like development, marketing, and team support. NFT holders and minters got a share of $CHR supply over time, with secondary sales royalties of 2% going to minters indefinitely, and an additional 1% to stakers, indicating potential speculative behavior. | |

| Protocols | They benefit from a public liquidity layer and can easily bribe $veCHR voters to attract more incentives – and therefore, more liquidity – to their pools. | |

| Users | They perform swaps within the platform and aim for the lowest slippage. Thus, they benefit from the high liquidity (TVL) that resides in the Chronos pools. They pay swap fees, which are then distributed to token lockers ($veCHR) based on their votes. I.e., $veCHR holders (token lockers) receive a pro-rata share of generated swap fees only for those pools they vote for. |