If you’re into crypto trading, you’ve probably heard the term “crypto arbitrage” thrown around like confetti at a blockchain conference. But what exactly is crypto arbitrage, and why should you care? Well, imagine this: Bitcoin is priced at $30,000 on Exchange A and $30,100 on Exchange B. That’s a $100 difference just waiting to be snatched up faster than a free pizza at a tech meetup.

Arbitrage is all about profiting from price differences across exchanges. And in 2024, with prices fluctuating faster than a caffeinated squirrel, crypto arbitrage bots have become the secret weapon for savvy traders. These bots automate trades, capture fleeting profit opportunities, and let you sip your coffee while they do the heavy lifting.

So, let’s dive into the top 10 crypto arbitrage bots or scanner.

1. CryptoHopper: The Beginner’s Best Friend

CryptoHopper is like the Swiss Army knife of crypto bots. It’s user-friendly, packed with technical indicators, and perfect for both newbies and seasoned traders. Want to test your crypto arbitrage strategies without risking real money? CryptoHopper offers paper trading, so you can practice until you’re ready to go pro.

Key Features:

- AI-enhanced bots

- Cross-exchange arbitrage

- Social trading (copy the pros!)

Pricing: Free version available, with paid plans starting at $19/month.

Platform: Windows

2. ArbitrageScanner.io: The Spread Tracker

This bot is like a bloodhound for price differences. It tracks spreads across centralized and decentralized exchanges, sending you rapid alerts so you can pounce on opportunities. Plus, it supports both spot and futures arbitrage, making it a versatile tool for low-risk strategies.

Key Features:

- Real-time spread alerts

- Manual bot operations

- Cross-blockchain tracking

Pricing: Free version available, with paid plans starting at $69/month.

Platform: Web browsers

3. Trality: For the Coders

If you’re the type who loves to tinker with code, Trality is your playground. It offers an advanced code editor and a marketplace where you can rent, sell, or share trading algorithms. Margin trading is also supported, which is perfect for experienced traders looking to maximize returns.

Key Features:

- Code editor

- Bot optimizer

- Marketplace for strategies

Pricing: Free version available, with paid plans starting at $99/month.

Platform: Windows

4. Bitsgap: The All-Rounder

Bitsgap is like the multitasking mom of crypto bots. It supports grid and DCA strategies, integrates with TradingView, and lets you manage your portfolio in real time. Whether you’re a day trader or a long-term investor, Bitsgap has something for everyone.

Key Features:

- TradingView integration

- Smart orders

- Automatic portfolio management

Pricing: Free version available, with paid plans starting at $29/month.

Platform: Windows, Mac, Android

5. 3Commas: The Pro’s Choice

3Commas is the bot equivalent of a luxury sports car. It combines preconfigured trading algorithms with customizable bots, making it a favorite among professionals. Advanced charting tools and copy trading features let you replicate successful strategies with ease.

Key Features:

- Copy trading

- Advanced charting

- Bot integration

Pricing: Free version available, with paid plans starting at $29/month.

Platform: Windows

6. Pionex: The Arbitrage Specialist

Pionex is like the ninja of arbitrage bots. With 12 unique bots and a smart trade function that adjusts stop-loss and take-profit levels automatically, it’s designed specifically for arbitrage. Plus, it’s free to use—just pay a small trading fee.

Key Features:

- AI strategy grid trading

- Automated stop-loss and take-profit adjustments

Pricing: Free, with a 0.05% trading fee.

Platform: Android, iPhone

7. Kryll: The Visual Strategist

Kryll is perfect for traders who prefer a visual approach. Its drag-and-drop functionality lets you create advanced trading setups without writing a single line of code. Plus, there’s a marketplace where you can rent or sell strategies.

Key Features:

- Visual strategy editor

- Historical data analysis

- Marketplace for strategies

Pricing: Free version available, with fees varying based on usage.

Platform: Android, iPhone

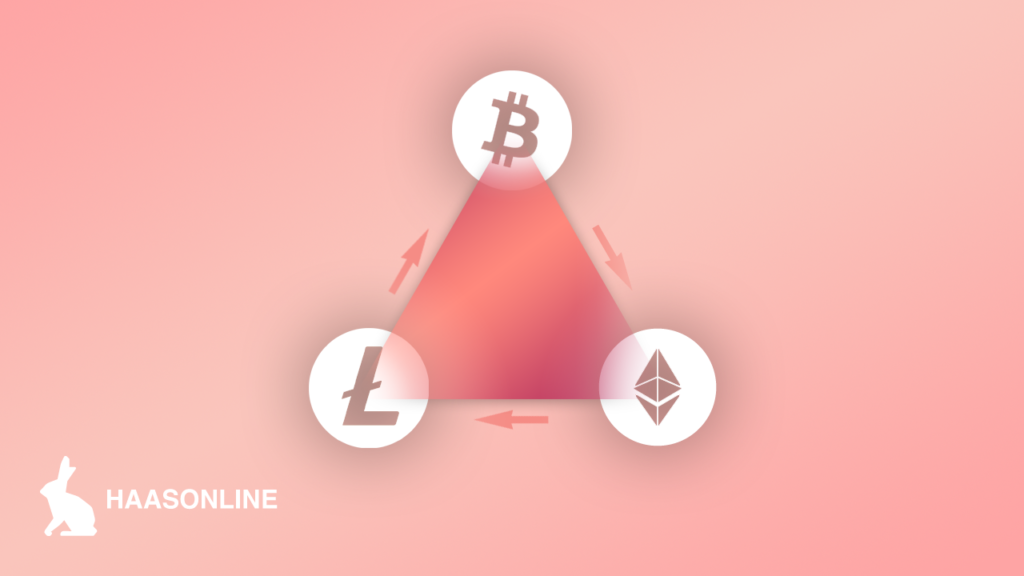

8. Mizar: The Triangular Arbitrage Pro

Misaka specializes in triangular arbitrage, which exploits price discrepancies between three cryptocurrencies. With real-time data and high-speed execution, it’s a powerful tool for advanced traders.

Key Features:

- Smart order execution

- Real-time data

Pricing: Free version available, with a 0.5% trading fee.

Platform: Windows

9. Wunder Trading: The Cloud-Based Bot

One Trading lets you access bots from any device with an internet connection. It supports DCA and futures bots, along with automated portfolio management, making it a comprehensive tool for serious traders.

Key Features:

- DCA and futures bots

- Automated portfolio management

Pricing: Free version available, with paid plans starting at $9.95/month.

Platform: Windows

10. HaasOnline: The Hands-On Tool

HaasOnline is perfect for traders who want full control. It supports multiple arbitrage types, including statistical and triangular arbitrage, and offers reliable paper trading for testing strategies.

Key Features:

- Backtesting

- Customizable bots

- Email support

Pricing: Free version available, with paid plans starting at $9/month.

Platform: Windows, Android, Mac

FAQs:

1. What is crypto arbitrage?

Crypto arbitrage is the practice of buying a cryptocurrency on one exchange where the price is lower and selling it on another exchange where the price is higher. The goal? To profit from the price difference. It’s like finding a $20 bill on the street, except you’re doing it digitally (and legally).

2. How do crypto arbitrage bots work?

Arbitrage bots are automated tools that scan multiple exchanges for price differences. When they spot an opportunity, they execute trades faster than you can say “blockchain.” These bots are designed to capitalize on fleeting price gaps, making them ideal for volatile markets.

3. Are crypto arbitrage bots safe?

Most reputable bots are safe, but like anything in crypto, there are risks. Always choose bots with strong security features, good reviews, and transparent pricing. And remember, no bot is 100% foolproof—so don’t bet your life savings on one.

4. Do I need coding skills to use arbitrage bots?

Nope! Many bots, like CryptoHopper and Bitsgap, are designed for beginners and don’t require any coding knowledge. However, if you’re a tech whiz, platforms like Trality let you code your own bots for maximum customization.

5. Which bot is best for beginners?

CryptoHopper is a great starting point. It’s user-friendly, offers paper trading (so you can practice without risking real money), and has a free version to get you started.

6. What’s the difference between triangular arbitrage and convergence arbitrage?

- Triangular Arbitrage: Involves three cryptocurrencies. For example, you might trade Bitcoin for Ethereum, Ethereum for Litecoin, and Litecoin back to Bitcoin to profit from price discrepancies.

- Convergence Arbitrage: Focuses on price differences between two assets on different exchanges. For instance, buying Bitcoin on Exchange A and selling it on Exchange B for a higher price.

7. How much do arbitrage bots cost?

Prices vary. Some bots, like Pionex, are free to use but charge small trading fees. Others, like HaasOnline, offer free versions with paid plans starting as low as $9/month. It all depends on the features you need.

8. Can I use arbitrage bots on my phone?

Absolutely! Many bots, such as Pionex and Kryll, have mobile apps for Android and iPhone. So, you can trade on the go while pretending to text during boring meetings.

9. What’s the catch with arbitrage bots?

While arbitrage bots can be profitable, they’re not a guaranteed money-making machine. You’ll need to account for trading fees, withdrawal limits, and the speed of transactions. Also, markets can move quickly, so timing is everything.

10. Do I need a lot of capital to start arbitrage trading?

Not necessarily. Some bots, like CryptoHopper, let you start with small amounts. However, more capital can mean more opportunities, as you’ll be able to take advantage of larger price gaps.

11. Can I use multiple bots at once?

Sure, but it’s like juggling flaming torches—it requires skill and focus. Using multiple bots can diversify your strategies, but it also increases complexity. Start with one bot, master it, and then consider adding more to your arsenal.

12. Are arbitrage bots legal?

Yes, arbitrage bots are legal in most countries. However, always check your local regulations and ensure you’re complying with tax laws. The last thing you want is the taxman knocking on your door.

13. What’s the best bot for advanced traders?

If you’re a pro, check out HaasOnline or 3Commas. These platforms offer advanced features like customizable bots, margin trading, and backtesting to fine-tune your strategies.

14. Can I lose money with arbitrage bots?

Unfortunately, yes. While arbitrage is generally low-risk, it’s not risk-free. Market volatility, technical glitches, and human error can all lead to losses. Always start small and never invest more than you can afford to lose.

15. Where can I learn more about crypto arbitrage?

Check out decentralized news platforms, join crypto communities, and download free resources like the book D-Millionaire (linked in the article). Knowledge is power—and in crypto, it’s also profit.

Types of Crypto Arbitrage Bots

- Convergence Arbitrage: Capitalizes on price conversions across assets.

- Triangular Arbitrage: Exploits price differences among three cryptocurrencies.

- Statistical Arbitrage: Uses historical data to identify profitable anomalies.

- Decentralized Arbitrage: Operates on DEXs using smart contracts.

- Geographic Arbitrage: Targets price discrepancies across different regions.

Final Thoughts

Crypto arbitrage bots are like having a personal assistant who never sleeps (and doesn’t complain about overtime). Whether you’re a beginner or a pro, there’s a bot out there for you. Just remember to consider factors like security, performance, supported markets, and fees before diving in.

So, what are you waiting for? Check out the links to these platforms, grab your favorite bot, and start automating your way to crypto profits. And hey, if you found this guide helpful, don’t forget to like, share, and subscribe for more crypto wisdom. Peace, love, and profitable trades! 🚀

Not Financial Advice Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto trading involves risks, including the potential loss of capital. Always do your own research (DYOR) and consult a licensed financial advisor before making any investment decisions. Trade responsibly!